ICGFM Promotes Knowledge Transfer Among Public Financial Management Experts

Friday, May 23, 2014

Wednesday, May 21, 2014

Friday, December 13, 2013

Tuesday, December 7, 2010

Cooperation on Audit Standards, Internal Auditors and Supreme Audit Insitutions

Ms. Derby introduced the four cornerstones of good governance: public officials; the governing body; internal auditors; and external auditors (SAIs). She concluded that the relationship between internal auditors and SAIs is both critical and beneficial to good governance and the effective use of public resources.

Ms. Derby described the evolution of audit standards, and the roles and responsibilities for internal audit and supreme audit institutions.

According to INTOSAI GOV 9100 (Guidelines for Internal Control Standards for the Public Sector), internal auditors examine and contribute to the ongoing effectiveness and efficiency of the internal control structure through their evaluations and recommendations and therefore play a significant role in effective internal control. Management often establishes an internal audit function as part of its internal control framework. In this tradition, the role of internal auditors is a critical part of an organization's internal control structure.

Ms. Derby introduced the benefits of coordination including:

- Strengthen mutual accountability

- Improved risk management

- More efficient audits

Risks of cooperation on audit standards include:

- Compromise on confidentiality

- Possible conflict of interest

- Use of different professional standards

Ms. Davis advocates the convergence of audit standards. She described the coordination and cooperation on these standards including:

- Communication of audit planning and audit strategy

- Collaborating on certain audit procedures, such as collecting audit evidence or testing data

- Communication of audit reports to each other

Ms. Davis suggested that internal and external auditors could use certain aspects of each other’s work to determine the nature, timing, and extent of audit procedures to be performed. She surveyed the audience to determine that there was not significant coordination between internal and external audit in most countries:

- 24% use each others work, 69% do not

- 18% share training programs 64% do not

- 34% share reports , 52% do not

- 37% work together on strategy, 41% do not

Ms. Davis advocated cooperation between internal and external audit throughout the entire audit lifecycle. She emphasized that assessment and communication should be documented in respective audit documents.

Monday, December 6, 2010

Convergence of Public Sector Audit Standards

Ms. Anerud described how International Organization of Supreme Audit Institutions (INTOSAI) worked with the International Standards of Auditing with the International Auditing and Assurance Board (IAASB). She described how the "clarity" project enabled the convergence of public sector audit standards. She showed the INTOSAI and IFAC structure for developing standards and how these standards were rationalized.

Mr. Anerud described the differences between private and public sector audit including:

- Terminology differences

- Broader role of government audit, especially in performance

- Inability for the government auditor to "withdrawal"

- Need for confidentiality in private sector audit vs. transparency in public sector

- Differences in materiality in government and what public expects to see reported

Jan Van Schalkwyk, Acting Corporate Executive from Auditor-General of South Africa described lessons learned. He described how audit is critical to democracy. Mr. Van Schalkwyk described the adoption audit standards by the Government of South Africa. Adoption of any standards in government requires legal standing and legal reform. He described challenges and lessons learned in adopting the INTOSAI standards. Mr. Van Schalkwyk pointed out that audit is critical to improving the lives of citizens.

Gail Flister Vallieres, Assistant Director, Financial Management and Assurance GAO described the move from the US "yellow book" standard to INTOSAI and international audit standards. Ms. Vallieres described how GAO could not immediately move to INTOSAI standard. Instead, GAO is sequencing a convergence to the standard. This process was facilitated when the AICPA US private sector auditing converged with ISA. She showed how the audit standards consist of basic accounting principles with standards specific to the public sector.

The exposure draft of the yellow book is available at the GAO web site.

IPSAS Lessons Learned

Dr. Hughes sees IPSAS as one the strategies to improve public financial management. He also recommended that cash management should be separate from budgetary controls, that the Treasury Single Account (TSA) be used and Integrated Financial Management Information Systems (IFMIS) adopted by governments.

Dr. Hughes emphasized the need for improved education in public financial management. He described the benefits of accrual accounting in government. These benefits include:

- Better accountability and better decisions

- More meaningful understanding of costs for goods and services

- Basis for performance management

12 steps for transition to IPSAS was described by Dr. Hughes:

- Develop organizational transition plan and coordinate with auditors

- Train staff

- Assess the information system changes required

- Prepare Policy and Procedures Manual for approved IPSAS policies

- Pilot test IPSAS policies and procedures in the new/upgraded information system

- Prepare IPSAS-compliant opening and closing Statements of Financial Position.

- Prepare proforma Statement of Financial Performance.

- Prepare proforma Statement of Net Assets/Equity.

- Prepare proforma Statement of Cash Flows

- Prepare proforma Statement of Comparison of Budget to Actual Amounts

- Prepare proforma IPSAS-complaint statements for controlled entities

- Prepare proforma Consolidated Statements

Dr. Hughes suggests that IPSAS may tackle public private partnerships, fiscal sustainability and social security reporting standards. He showed the difference in size between the cash and accrual version of IPSAS.

Addressing Current Governance and Risk Management Challenges in Governmental and

International Organizations" at the ICGFM Winter Conference. The IaDB has been a prime mover in public financial management reform in Latin America and the Caribbean. He described the changes in the organization to improve the performance of the organization.

On a lighter note, Mr. Siegfried described the wonders of risk management thanks to George Costanza from the Seinfeld television series.

Mr. Siegfried described the current global economic challenges that generate uncertainty and unpredictability including turmoil in financial markets, changing regulatory environment and budget restrictions. Mr. Siegfried believes that this uncertainty presents the internal audit profession with an opportunity to demonstrate leadership in risk management, control and governance. He cautioned that internal audit is crucial to improve the credibility of governance structures. He warned the attendees that internal audit is often seen as inflexible and non-responsive to emerging risk. And, many organizations have cut disproportionately in oversight because of reduced budgets.

Mr. Siegfried described the important role of internal audit to help management identify risks, design risk management strategies, and monitor the effectiveness of control. He pointed He described lessons learned. Mr. Siegfried emphasized the differences between risk management, control and governance. He recommended that organizations must take some risk, otherwise the organization become stagnant.

Mr. Siegfried suggested that organizations must balance risk and opportunity. Risk management is about risk mitigation, not about eliminating risk. He described governance structures and the principles for enterprise risk management. He recommended more holistic views on risk management. He pointed out that Standard & Poors is now using enterprise risk management as part of organizational valuation.

Mr. Siegfried presented an overview of risk management for international organizations. He suggested that risk management does not need to be a centralized function. Accountability is critical regardless of whether centralized or decentralized risk management models are used.

He showed the roles that internal audit should take, could take and should not take in risk management. He spoke about risk velocity where problems can happen very quickly, like the earthquake in Haiti.

There is a significant value proposition to internal audit. Internal audit needs to move from recognized to trusted to valued. Mr. Siegfried provided an overview of the risk management evaluation framework. He provided a list of financial, compliance, strategic and operational risks to consider.

Mr. Siegfried concluded by suggesting that risks facing organizations are unprecedented and stakeholders’ expectations continue to increase. He recommended that individual practitioners and organizations must ‘raise the bar’ to most effectively represent and advocate for strong governance and risk management. Organizations need to move from hindsight to insight to foresight.

Saturday, December 4, 2010

Materiality in Government Auditing

Abstract

There is a striking difference in the approach taken in the preparation of public sector specific guidance on accounting and auditing. While the International Public Sector Accounting Standards Board (IPSASB) issues stand-alone public sector accounting standards, the International Organization of Supreme Audit Institutions (INTOSAI) issues practice notes, which provide supplementary guidance for the public sector, in addition to the considerations specific to the public sector contained in the International Standards on Auditing. There is a similarity in that both IPSASB and INTOSAI fly in the jet stream of private sector standard setters. IPSASB only deviates from the International Financial Reporting Standards (IFRS), issued by the IFRS Board, for public sector specific reasons. INTOSAI adds guidance to the International Standards on Auditing, issued by the International Auditing and Assurance Standards Board (IAASB). These public sector specific practice not es are called International Standards of Supreme Audit Institutions (ISSAI).

Materiality in Government Auditing

Thursday, October 14, 2010

Control Self Assessment

Miguel Garcia-Gosalvez Program Director. Anti-Corruption & Local Governance, Casals & Associates, Inc. , a DynCorp International Company presented at the October ICGFM DC Forum on Control Self Assessment.

Miguel Garcia-Gosalvez Program Director. Anti-Corruption & Local Governance, Casals & Associates, Inc. , a DynCorp International Company presented at the October ICGFM DC Forum on Control Self Assessment.Control Self Assessment (CSA) is a means for taking the pulse of an organization, collecting information on the state of its institutional health, and assessing risks to achieving

its organizational objectives. Mr. Garciz-Gosalvez explained how the process was implemented in Colombia to improve government informal controls and how it is now being implemented in Paraguay.

Friday, June 11, 2010

Public Financial Management in Sudan

Public Financial Management in Sudan

Independence of Supreme Audit Institutions in Sub-Saharan Africa

Independence of Supreme Audit Institutions in Sub-Saharan Africa

Recent Public Financial Management Publications and other Resources

Fiscal ROSCS and PEFA Assessments: A Comparison of Approaches

Mario Pessoa and Richard Allen (2010)

http://blog-pfm.imf.org/files/note.pdf

This note summarizes the main similarities and differences in approach and coverage of fiscal ROSCs and PEFA assessments. These are two approaches used by international bodies to assess the quality public financial management in governments, especially those in the Global South.

A fiscal ROSC differs from a PEFA assessment in focusing particularly on transparency and accountability aspects of PFM systems, grouped under four pillars:

- clarity of roles and responsibilities for PFM within government;

- open budget processes, covering all PFM-related processes of government;

- public availability of information, specifying the kinds of PFM information that should be accessible to the public; and

- finally, assurances of integrity, covering issues of data quality as well as the need for and quality of external scrutiny of PFM information.

A PEFA assessment focuses primarily on the extent to which PFM systems and procedures deliver efficient and effective outcomes in the six critical areas. It covers fiscal transparency issues insofar as they affect PFM effectiveness. The emphasis is on the budget process itself, particularly in respect of the main PEFA indicator set, although PEFA assessments also include some description of the legal framework for fiscal management, reforms being undertaken, and public access to key information. PEFA assessments have also focused predominantly on low- and middle-income countries, while fiscal ROSCs have also been carried out in a substantial number of high-income countries.

Achieving Better Value for Money in Health Care

OECD Publishing (November 2009)

http://www.oecdbookshop.org/oecd/display.asp?K=5KSF5CRSGQNS&LANG=EN

Rising public health care spending remains a problem in virtually all OECD and EU member countries. As a consequence, there is growing interest in policies that will ease this pressure through improved health system performance. This report examines selected policies that may help countries better achieve the goal of improved health system efficiency and thus better value for money. Drawing on multinational data sets and case studies, it examines a range policy instruments. These include: the role of competition in health markets; the scope for improving care coordination; better pharmaceutical pricing policies; greater quality control supported by stronger information and communication technology in health care; and increased cost sharing.

Strategic Financial Management

http://www.audit-commission.gov.uk/nationalstudies/localgov/Pages/strategic-financial-management.aspx

This national study from the UK Audit Commission builds on the work done for the World Class Financial Management, especially financial governance and leadership, financial planning, and finance for decision making. The study will review how councils develop and use strategic financial planning tools and will help them to improve strategic financial management and links to the planning of services and other interventions. It will examine the costs and benefits of strategic financial planning, determine which approaches, if any, offer most benefits and identify the key principles of effective strategic financial and risk management.

No evidence that Public Private Partnerships provide value, says National Audit Office (UK)

http://www.publicfinance.co.uk/news/2009/11/no-evidence-that-private-funding-schemes-provide-value-says-nao/

Public Private Partnerships (PPPs) have spread from the UK to many countries, but there is increasing evidence that they may not provide value for money and the alternatives are not adequately researched. UK Ministers do not have strong evidence to show that PPPs offer the best value for money, UK government auditors have warned.

In evidence prepared for a parliamentary inquiry in November 2009, the National Audit Office warned: ‘Our view is that private finance can deliver benefits, but it is not suitable at any price or in every circumstance.’ The NAO paper noted that ‘assessing the pros and cons of alternative procurement routes is especially important in the recession’. Rising costs of private finance since the credit crunch had ‘implications for their value for money’.

The paper added: ‘We have yet to come across truly robust and systematic evaluation of the use of private finance built into PPPs at either a project or programme level’ – evidence that committee chair Lord Vallance described as ‘quite unequivocal’.

Systems to collect comparable data from projects using different procurement routes were ‘not in place’, the paper said. ‘Unless such systems are established, together with robust evaluation of the overall whole-life costs of alternative forms of procurement, government cannot satisfy itself that private finance represents the best VFM option.’

In Nigeria the government has also seen PPPs as an important way of acquiring public investment, but again recently suffered a set-back. Plans to concession airports to private investors in a public private partnership appear to have been abandoned due to opposition from the trade unions.

Greater Aid Transparency: crucial for aid effectiveness, ODI Project Briefings 35, London: ODI

Samuel Moon and Tim Williamson (January 2010)

www.odi.org.uk/resources/details.asp?id=4673

This paper sets out and explores the link between donor aid and recipient country budgets, and the role greater transparency about aid can play in improving budget transparency, the quality of budgetary decisions, and accountability systems. The paper goes on to explore how current initiatives to improve aid transparency can best support better budgets and accountability in aid dependent countries. These efforts provide an important opportunity to enhance the effectiveness of both the recipient governments’ own spending and the aid they receive from donors.

It concludes that publishing better information on aid requires compatibility with recipients’ budgeting and planning systems. The research findings suggest that recipient budgets bear many similarities, but this is not reflected in current formats for reporting aid. Finally, it concludes that the poorest countries will lose out if donors do not publish aid information that is easy to link with recipient government budget systems.

Publishing What We Learned: An Assessment of the Publish What You Pay Coalition

Mabel van Oranje and Henry Parham (2009)

http://www.publishwhatyoupay.org/en/resources/publishing-what-we-learned

Publish What You Pay (PWYP) is a global civil society coalition that helps citizens of resource-rich developing countries hold their governments accountable for the management of revenues from the oil, gas and mining industries. Natural resource revenues are an important source of income for governments of over 50 developing countries. When properly managed these revenues should serve as a basis for poverty reduction, economic growth and development rather than exacerbating corruption, conflict and social divisiveness.

The PWYP coalition was founded in 2002 by a small, ad hoc group of London-based NGO representatives to tackle the ‘resource curse’ by campaigning for greater transparency and accountability in the management of revenues from the oil, gas and mining industries. Since then, the PWYP coalition has grown to become a global network comprised of community organisations, international NGOs and faith-based groups in more than 70 countries.

The report discusses the origins and evolution of PWYP from 2002 to 2007. It also assesses the effectiveness of PWYP’s advocacy and policy endeavours and examines how the Coalition has operated internationally. In this sense, the report is not only a narrative of PWYP’s history and accomplishments, but a practical tool to shine a light on the strengths and challenges which face a global civil society coalition.

Carbon Trading: How it works and why it fails

Oscar Reyes and Tamra Gilbertson (November 2009)

Dag Hammarskjöld Foundation

http://www.tni.org/carbon-trade-fails

Carbon trading lies at the centre of global climate policy and is projected to become one of the world’s largest commodities markets, yet it has a disastrous track record since its adoption as part of the Kyoto Protocol.

This book outlines the limitations of an approach to tackling climate change which redefines the problem to fit the assumptions of neoliberal economics. It demonstrates that the EU Emissions Trading Scheme, the world’s largest carbon market, has consistently failed to cap emissions, while the UN’s Clean Development Mechanism (CDM) routinely favours environmentally ineffective and socially unjust projects. This is illustrated with case studies of CDM projects in Brazil, Indonesia, India and Thailand.

The UN climate talks in Copenhagen discussed ways to expand the trading experiment, but the evidence suggests it should be abandoned. From subsidy shifting to regulation, there is a plethora of ways forward without carbon trading – but there are no short cuts around situated local knowledge and political organising if climate change is to be addressed in a just and fair manner.

This accessible, well-researched book provides a devastating critique of both the theory and practice of carbon trading.

Why Has Domestic Revenue Stagnated in Low-Income Countries? London: The Centre for Development Policy and Research, Development Viewpoint 41

Terry McKinley (2009)

http://www.soas.ac.uk/cdpr/publications/dv/file55026.pdf

"There has been miserably slow progress in increasing domestic revenue in low-income countries since the 1990s. In order to find out why, this publication draws on an extensive analysis of disaggregated revenue data for low-income countries in sub-Saharan Africa, South and Southeast Asia, and Central Asia.

Based on this analysis, it is contended that the reigning 'tax consensus' has placed an inordinate emphasis on boosting domestic indirect taxes, and the value added tax (VAT) in particular. These taxes cover domestic goods and services in the formal sector.

At the same time, the 'consensus' has advocated eliminating import taxes (in order to liberalise trade) and lowering tax rates on corporate profits (in order to compete with other rate-cutting countries).

Consequently, trade taxes have been particularly hard hit while increases in direct taxes, which cover mainly personal income and corporate profits, have generally been anaemic.

Overall revenue has ended up stagnating because of the resultant reliance on boosting revenue from only one major component, i.e., taxes on domestic goods and services. The pre-eminent instrument for this purpose has been the VAT, which has replaced sales taxes (as well as import duties) in many countries.

ActionAid on Tax

http://www.actionaid.org.uk/doc_lib/accounting_for_poverty.pdf

ActionAid UK has published a report, Accounting for Poverty, to underpin its tax campaign. The report draws together a wide range of sources, some familiar and some new, to make the case for tax justice and development.

One new contribution is ActionAid’s calculation that, if every developing country were able to achieve tax revenues equivalent to just 15% of national income (the OECD average is 37%, while Bangladesh raises just 8%) $198 billion per year of new money would be available to fight poverty in the poorest countries.

A Study on Gap Analysis of Indian Government Accounting with International Standards

Government Accounting Standards Advisory Board (November 2008)

http://www.gasab.gov.in/pdf/Gap_Analysis.pdf

The Cash Basis International Public Sector Accounting Standard (IPSAS) may be the international standards for public sector accounting, but it cannot claim to represent best practice as it appears that not a single country has implemented this standard since it was first issued in 2003.

The key problem appears to be the mandatory requirement to produce consolidated accounts which should include all controlled entities (including government companies, business enterprises and all parastatal organisations). Many countries have decided that this is not practically possible, is too onerous or would produce misleading information. This includes a number of governments who would otherwise like to have implemented the Cash IPSAS including India, Malaysia, Mongolia, Ghana, Uganda and Malta.

This publication reviews the experience of the Government of India in comparing its approach to financial reporting to that outlined in the Cash Basis International Public Sector Accounting Standard. India is attempting to adopt this standard, but it does not accept some of the Standard’s key requirements, for example, the consolidation of government business enterprises and the disclosure of third party payments.

On the first issue, the document actively argues against providing such a consolidation. “Though this is fundamental requirement of Cash IPSAS” it says, “it is likely to cause more distortion than bringing in clarity in the financial statements of government” (page 9).

It is hope that the current review of the Cash Basis IPSAS will result in the development of a more practical standard which most governments which are not experimenting with the accrual basis will be able to use. However, what is really needed is some extensive research to identify current best practices in public sector accounting and to codify this. We need to develop international standards, from the bottom up, based on existing good practice not on pre-conceived ideas borrowed from the private sector.

Gender Budgeting: Practical Implementation Handbook

Sheila Quinn (2009)

http://blog-pfm.imf.org/files/gender-budgeting-practical-implementation-handbook.pdf

The book’s focus is “to act as a guide to the practice of gender budgeting." It is, however, not really suited for those who have no prior knowledge of gender budgeting; there are many other publications which articulate the rationale for, the background of, and the history of gender budgeting, and a sample of these are listed toward the end of the handbook in the resources section. The handbook assumes an understanding of gender budgeting, of the objectives of a gender equality strategy, of the ways in which gender inequality manifests itself, of the need for structural change in order to tackle unintentional gender bias, and of the basics of gender mainstreaming as a strategy to address gender equality. Gender budgeting, as a tool of gender mainstreaming, cannot be implemented without a grasp of these fundamentals.

Gender budget pilot initiatives have over the years brought about a new and deeper understanding of gender issues. Adopting a gender budgeting strategy requires prior experience in addressing gender equality. The chapter, "How to do Gender Budgeting" starts by discussing the type of experience and conditions that need to be in place in order to engage with gender budgeting. The temptation in using this handbook might be to skip these sub-sections and move ahead to the text dealing with specific tools and approaches. There is a considerable demand for specific tools, for the ABC of what to do, so to speak. However, the fundamentals cannot be by-passed or short-circuited. This is particularly the case if the practice of gender budgeting is to move beyond an analytic exercise to a mainstreaming strategy. The experience of many practitioners is that, since the tools need to be adapted, it is most important to focus on developing an approach based on local circumstances. The actual tools of analysis, of reformulation, and of mainstreaming will emerge when the goal has been identified.

What are the real risks of adopting accrual accounting?

Many conference presentations, journal articles and books extol the virtues and benefits of the public sector adopting accrual accounting, but few provide any real evidence of the actual experience. Two audit reports from the Auditor General of the Cayman Islands provide a brutally frank and honest account of what can go wrong.

In July 2008, the Auditor General, Dan Duguay, issued a special report, “describing a very grim assessment of the state of financial accountability reporting throughout the Cayman Islands Government”. Ten years after the Cayman Islands agreed to adopt accrual accounting, the first accrual accounts were 2.5 years late and the Auditor General found the “current situation deplorable” and he believed that “the legislative assembly has lost control of the public purse”.

In the second report, issued in April 2010, the Auditor General concluded that, “the state of financial accountability reporting has gotten worse in the two years since I last reported on this matter”. Despite the Government spending an additional $1 million in the last fiscal year to address the problem, the Auditor General assessed these efforts as being, “too limited and therefore; insufficient to address the situation”. He concluded his second report by saying, “I believe this situation has become a national crisis that could lead to tremendous consequences for the Cayman Islands Government if not addressed immediately”.

The Cayman Islands are not a poor country, the per capita income is one of the highest in the world and, as it is a tax haven and financial services centre, there are many qualified accountants available locally. If the introduction of accrual accounting can go so horribly wrong in the Cayman Islands, imagine what could happen in the many developing countries where accrual accounting is still actively being promoted for the public sector.

The next time you hear a speaker listing the many benefits claimed for accrual accounting ask what the actual evidence is from the few countries which have adopted this approach. The objective and authoritative studies, from the UK for example, suggest that the costs are significant and that the actual benefits are minimal. Now we have reports from the Cayman Islands of the very real risks involved of adopting this approach to public sector accounting.

The first report of the Auditor General on the State of Financial Accountability Reporting (July 2008) in the Cayman Islands Government is available from http://tinyurl.com/accrualcayman1

The second report of the Auditor General of the Cayman Islands, issued in April 2010, is available from http://tinyurl.com/accrualcayman2

Recent Public Financial Management Publications and Other Resources

International Journal on Governmental Financial Management published

Table of Contents

1. A Science-Based Approach to the Conceptual Framework for General Purpose Financial Reporting by Public Sector Entities

Petri Vehmanen

2. Public Sector Accounting: Democratic control of public money by using administrative cameralistics

Norvald Monsen

3. Sovereign Wealth Funds

Hany H. Makhlouf

4. Public Financial Management in Sudan

Hussein Mohamed El-Nafabi

5. Independence of Supreme Audit Institutions in Sub-Saharan Africa

Andy Wynne

6. A Prescriptive Model of the Transition to Accrual Accounting in Central Government

Hassan A. G. Ouda

7. A proposed definition of the Modified Cash Basis

Michael Parry

8. The Four Dimensions of Public Financial Management

Michael Parry

9. Recent Public Financial Management Publications and other Resources

Andy Wynne

The world appears as a set of contradictions. High levels of government spending have prevented, for the present at least, a full-scale economic decline. But it is not clear that economic revival will be achieved soon nor the jobs and real economic growth which are needed to eradicate the poverty that still scars the globe. There are also contradictions over government spending. So, for example, whilst the US, UK and other governments face large scale opposition to their military interventions, it is social spending which is still questioned by many of their legislators. Barak Obama faced sustained opposition to the introduction of health reforms which will eventually give access to modern health-care to around 30million Americans. In the UK strikes are threatened in universities and the public service as a reaction to reduced spending whilst the government appears powerless to prevent the continued payments of bonuses to directors, even in banks which have been taken into public ownership. In addition, both the main parties in Britain are promising significant reductions in public spending to bring government debt down to a ‘sustainable’ level.

Greece appears to be the test case, with a series of general strikes in opposition to the draconian public spending cuts aiming to reduce the level of the government’s budget deficit. It is ironic that it was the toxic debts of the banks that led to the credit crunch and the resulting world recession. However, it is these same financial institutions who are now determining whether government debt, arising from the need to save their own banking and financial sector, is sustainable.

In this situation it is to be hoped that public sector financial managers and auditors will gain greater self-confidence. After two or three decades of criticism of so called public sector inefficiency and exhortations for the public sector to adopt private sector approaches, the experience of the global recession should lead to some serious re-thinking – a process which this Journal is attempting to play an active role.

The first paper of this issue, by Petri Vehmanen of the University of Tampere, Finland provides an insightful critique of the draft conceptual framework recently issued by the International Public Sector Accounting Standard Board. Petri observes that whilst the prime aim of private sector financial statements is to provide information for investors to make decisions about the entity, the prime purpose of public sector financial statements is to enhance accountability. This should be recognised and would result in the definitions of such prime elements as assets and liabilities being revised. His paper also recasts the qualitative characteristics of public sector financial statements. Petri concludes by saying that his proposals “are by no means radical”. However, they do provide a comprehensive and damming critique of the work of the International Public Sector Accounting Standard Board and so it is re-assuring that so few countries have yet to adopt their approaches to accrual accounting or indeed the cash basis of accounting.

Our second paper is a further part of the series of articles in which Norvald Monsen has outlined a uniquely public sector approach to accounting and book keeping – cameral accounting. This was developed in German speaking counties and, until now, has remained largely unknown to English readers. Norvald provides an overview of the main tasks of traditional public sector accounting, followed by a detailed exposition of administrative cameralistics, focusing on the closing of the accounts and budgetary comparisons. A commentary section then explains how the four tasks of traditional public sector accounting are taken care of within cameral accounting. This is finally compared with both traditional commercial accounting and the new public sector accounting outlined in the International Public Sector Accounting Standards.

The next paper, by Hany H. Makhlouf, provides a useful introduction and overview of sovereign wealth funds. These funds managed by 23 countries, mainly those with significant income from natural resources, for example, oil, have been of increasing interest in recent years and are expected to grow in the future if, as expected the price of crude oil triples in price over the next 20 years. However, the global economic meltdown had a major impact on their success and led many to a re-think of their strategic approach.

Our next two papers consider two aspects of public sector audit. The first by Hussein Mohamed El-Nafabi considers the issue of corruption in Sudan and the important role of the Auditor General in the fight against it. The objective of this study is to address the perverse incentives for financial corruption and try to provide practical solutions. It is recognised that, as in many countries, financial corruption is deeply rooted and institutionalized and the fight against it is likely to be long and difficult. However, the paper ends with a series of recommendations to assist with this struggle.

In the next paper, Andy Wynne considers the key issue of independence for supreme audit institutions (auditors general in English speaking countries). Models of public sector ‘external’ audit type institutions are described for English and French speaking African countries. Neither approach can claim to fully meet international standards for independence, but different approaches to the provision of audit type services are considered to be acceptable. This emphasises the need to understand existing systems before external models are adopted as part of a reform process.

In the next paper Hassan A. G. Ouda returns to the issue of the introduction of accrual accounting. He describes a comprehensive model of the transition framework that aims at explaining the whole reform process including all relevant factors. The model takes into consideration the fact that the transition to accrual accounting is a major cultural, administrative and technical change and, in order to successfully be adopted, must take place in phases with a clear plan of progress established from the outset. However, the challenge of demonstrating the actual (as opposed to the assumed) benefits of moving to accrual accounting is not taken up in this paper.

In two relatively short articles, Michael Parry first proposes a definition of the modified cash basis of accounting and then describes the four dimensions of public financial management. We welcome this approach of relatively short articles addressing key issues in governmental financial management and would encourage other authors to follow Michael’s example in future issues.

As initiated in our last issue, we end this issue with a section introducing recent public financial management publications and other resources which we hope will be of interest to readers of the Journal. We would be pleased to receive reviews and suggestions of other resources which we should refer to in future issues.

2010_Vol_X_No_1_IJGFM

If you would like to continue the debates raised in this issue please start thinking about contributions for the next issue of this Journal, the ICGFM blog or attend future ICGFM events. We look forward to hearing from you!

Andy Wynne Doug Hadden Jim Ebbitt

Editor Vice President: Communications President

Wednesday, May 19, 2010

XBRL Work Shop at ICGFM Conference

Liv Watson managed an XBRL workshop at the 24th Annual Conference on Public Financial Management. This is a follow-up from her presentation XBRL: The Language of Government 2.0. Attendees to the conference were very interested in the use of XBRL in government. Ms. Watson encouraged attendees to read XBRL documents on-line.

Liv Watson managed an XBRL workshop at the 24th Annual Conference on Public Financial Management. This is a follow-up from her presentation XBRL: The Language of Government 2.0. Attendees to the conference were very interested in the use of XBRL in government. Ms. Watson encouraged attendees to read XBRL documents on-line.Many countries do not mandate the use of XBRL. XBRL often becomes widely adopted according to Ms. Watson. Regulation sometimes follows adoption.

Global adoption drivers according to Ms. Watson include:

- Economics to reduce administrative burden, support multiple languages easily

- Support global standards and pressure from large international organizations

- IFRS adoption and GAAP alignment

- Support for capital market transparency

- Alignment in regulatory consistency

- Basel II banking supervision

- Integrate with multiple standards such as ISO, W3C, Swift, OECD

- Support frequent legislative changes, particularly for changes to reporting standards

- Legislature or Ministry of Finance may drive adoption

- Pressure from funding agencies for proper tracking

- Improved budget planning

- Support of decentralized reporting such as from municipalities to the central government

- Improved data collection through standards in areas such as taxation, land registration

- Integration of tax information with procurement processes

- Ease of audit through supreme audit institutions

- Encouragement from international organizations and development partners

- Improved statistical information for regulators

- Trade facilitation for regional and global trading organizations

- Ease of business registration

- Media and civil society may put pressure on governments

- Globalization affect where countries that are more transparent will be seen as more stable for business

- Demands for government transparency

- Faster closing of government accounts and production of reports

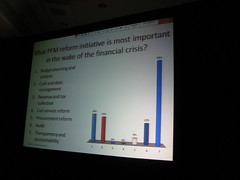

Transparency and Accountability Most Important PFM Reform

50% of attendees at the 24th Annual ICGFM Conference agreed that transparency and accountability improvement is the most important government reform necessary after the financial crisis.

50% of attendees at the 24th Annual ICGFM Conference agreed that transparency and accountability improvement is the most important government reform necessary after the financial crisis.ICGFM, the International Consortium on Governmental Financial Management, attracts members from around the world. The Public Financial Management (PFM) experts at the conference in Miami Florida come from over 35 countries.

ICGFM uses audience voting to ask questions about PFM reform. The top votes for the most important reform initiative in wake of the financial crisis was:

- Transparency and accountability 50%

- Budget planning and analysis 18%

- Cash and debt management 16%

- Audit 13%

- Procurement reform 8%

Tuesday, May 18, 2010

The Expanding Role and Increasing Responsibility of Public Auditors

Rakesh Verma, the Principal Accountant General of India described the trend toward greater involvement and reliance on public auditors in public financial management. He pointed out that there are those who believe that India is over-regulated. He does not agree with this view. Mr. Verma described the impact of the financial crisis on countries around the world. This has resulted in monetary policy changes and other public management adjustments.

Rakesh Verma, the Principal Accountant General of India described the trend toward greater involvement and reliance on public auditors in public financial management. He pointed out that there are those who believe that India is over-regulated. He does not agree with this view. Mr. Verma described the impact of the financial crisis on countries around the world. This has resulted in monetary policy changes and other public management adjustments.Mr. Verma described the impact of Public Private Partnerships on public finances. PPP's are high risk. Therefore, the role of the public auditor is critical according to Mr. Verma. PPP analysis is challenging to ensure that risk is properly distributed. He described the INTOSAI PPP guidelines for auditing for value for money.

Mr. Verma described problems with private auditors with many private sector companies. He warned that there are important lessons here for public auditors. Public auditors do not have a financial incentive to find unqualified audits And, constitutions around the world guarantee the independence of public auditors to ensure more reliable audit.

Audits are moving from compliance to performance in the public sector according to Mr. Verma. Compliance audit are still critical particularly because these address legal issues. He described the need to audit companies where the government owns more than 50%.

Mr. Verma described lessons learned from the financial crisis. Many interventions by public authorities have been based on the grounds of "too big to fail" rather than in the public interest. The public interest is better served by autonomous and independent organizations. He described how public audit can expand. Mr. Verma argued that government audit information should be published in newspapers to get scrutiny by the common man. He described the approach for risk-based audit in India.

Monday, May 17, 2010

Internal Controls and Risk Management

Mr. Andrade agrees that it is better to practice integral risk management when there is sufficient information. However, risk can be managed without full information.

No country can achieve objectives without an internal control structure. Governments can only encourage citizen participation through publishing of information according to Mr. Andrade. Information that is not published has no value. Audit is an important part of the internal control structure. Mr. Andrade provided a full discussion of an internal control and risk management structure.

The control environment requires ethics, integrity and senior leadership. This supports accountability. Mr. Andrade provided a detailed list of actions necessary to create a control and risk management environment. He emphasized the need for goals and indicators. The higher the objective, the higher the risk.

Mr. Andrade said that accountability and transparency requires processes. It is very difficult to ensure accountability without proper processes. These processes must follow each step from the data being available until it is disseminated. Human Resource processes are also required for internal control according to Mr. Andrade. This helps set the environment for internal controls. Each step must have accountability, according to Mr. Andrade. The processes must be defined. The way in which public servants are accountable must be defined.

Training and capacity building is critical to effective internal controls, according to Mr. Andrade.

Information Technology can enable more effective transparency. Mr. Andrade warns that the IT system needs to be properly designed and there needs to be a strategic plan. The system must be fully integrated.

Transparency requires simple information publishing such as government budgets and budgets by results, according to Mr. Andrade. This information is accessible to the public and adds social control to government and accountability.

Mr. Andrade recommends that auditors become active in promoting internal controls. Modern audit requires active participation to improve integral risk management. Risk management also means that there is a reasonable chance of achieving goals and risk is mitigated. Mr. Andrade introduced a risk map to show where resources should be focused. Organizations should begin articulating and managing risk even before detailed statistics are available. Mr. Andrade showed a risk management audit plan in a matrix format.

Mr. Andrade ended his presentation by observing that people do not like controls. But, proving the results of controls can achieve acceptance.