Co-Chair David Nummy of Grant Thornton reflected on the strength of the workshops on cash management, Treasury Single Account and gender equality. He thanked the audio visual and translation teams.He encouraged attendees to look to the upcoming Winter Conference in Washington DC. There will be a competition for presentations

ICGFM President Jim Ebbitt brought the 24th Annual International Consortium on Government Financial Management to an end in Miami. Mr. Ebbitt welcomed the discussions and disagreements with speakers because this advances public financial management practices. He thanked the program steering committee and Pat Cornish, the managing director.

ICGFM Promotes Knowledge Transfer Among Public Financial Management Experts

Working globally with governments, organizations, and individuals, the International Consortium on Governmental Financial Management is dedicated to improving financial management by providing opportunities for professional development and information exchange.

Friday, May 21, 2010

Ensuring Gender Equality in Government

Nadereh Chamlou of the World Bank discussed the talent crisis and the need for gender diversity to support economic growth. She started her presentation with surveys about the workforce in participant countries.

79% of the ICGFM attendees believe that there is a link between female participation in the workforce and an increase in GDP. The most binding constraint on development in countries survey found:

- Financial 56%

- Natural resources 12%

- human resources 43%

Ms. Chamlou believes that the world is at the dawn of a new talent crisis. Demographic changes means that the talent pool is being reduced while countries attempt to develop. This is a problem for all governments and businesses. She pointed out that forecasts suggest that the global population of 60+ is projected to exceed the under15 cohort for first time in history. She warns that developed economies will not find enough employees in home markets to sustain profitability and growth. There is also a brain drain from developing to developed countries. She discussed the "brain waste" defined as women and minorities being underutilized in the work place.

Numerous studies were quoted by Ms. Chamlou that ties GDP growth with gender equality.

- Gender is Smart Economics (The World Bank, 2009)

- The Bottom Line: Connecting Corporate Performance and Gender Diversity (Catalyst, 2004)

- Stimulating Economies through Fostering Talent Mobility (World Economic Forum, 2009)

- The Gender Corporate Gap report (World Economic Forum, 2009)

Ms. Chamlou provided additional statistics on the persistent gender gap. She pointed out that the gender gap is a persistent problem in developed and developing countries. She presented studies from the Middle East and North Africa region. Many of these studies overturned some myths about gender inequality.

Ms. Chamlou concludes that Human Capital is the most indispensable driver of economic growth and the foundation of innovation. Bridging the gender gap at all levels is critical for talent management according to Ms. Chamlou. She warns that the talent gap may be much wider than many think.

Nadereh Chamlou is Senior Advisor to the Chief Economist for the Middle East and North Africa Region of the World Bank. In her 28 years with the World Bank, she has worked in technical and managerial positions across the organization in such areas as economic management, private and financial sector development, infrastructure and environment, corporate governance and the knowledge economy. Her experience also extends to Latin America, East Asia and Pacific, and Eastern Europe. She co-authored a World Bank flagship report, "Corporate Governance: A Framework for Implementation," in 1999, and was co-founder of the World Bank/OECD-sponsored Global Corporate Governance Forum, which she headed from 1998 to 2000. She was the principal author of "Gender and Development in the Middle East and North Africa Region–Women in the Public Sphere" in 2003, and of "The Environment for Women's Entrepreneurship in the Middle East and North Africa Region" in 2008.

Nadereh chamlou crisis de talentos y brecha de género espanol

View more presentations from icgfmconference.

Nadereh chamlou le déficit de talents et l’écart entre les sexes francais

View more presentations from icgfmconference.

Value of Treasury Single Accounts in Government

Sailendra Pattanayak, Senior Economist, Fiscal Affairs Department, the International Monetary Fund, discussed Treasury Single Accounts (TSA). He suggests that the TSA aids cash management and facilitates other functions in public financial management. He presented diagrams showing the typical payment system with many bank accounts and the use of a TSA.

Mr. Pattanayak pointed out the TSA handles payments from all spending units separately. Unlike the use multiple bank accounts, the cash balances roll up to a single account.

The TSA is not just a single bank account. It can be multiple accounts rolled up to a single accounts. Mr. Pattanayak pointed said that the TSA is a unified structure of government bank accounts that gives a consolidated view of government cash resources. It could be just one account or a set of linked accounts (main and subsidiary). He warned that as far as possible, all public entities should be consolidated to the TSA. The TSA should be legally recognized, institutionally robust and stable according to Mr. Pattanayak.

Mr. Pattanayak agreed with previous presentations on cash management in that cash controls should be de-linked from budget controls. He emphasized that the TSA can contain ledger sub-accounts for control and monitoring purposes, but these should not contain over-night balances. He said that options for accessing the TSA is mainly dependent upon institutional structures and payment settlement systems. The cash balance in the TSA is maintained at a level sufficient to meet daily operational requirements of the government according to Mr. Pattanayak.

The TSA is nothing new according to Mr. Pattanayak. He warned that revenue and expenditure transactions should be classified through a well-developed chart of accounts and not by maintaining distinctive bank accounts for them. He recommends that the TSA should be maintained in the national currency because budget execution is in the national currency.

The benefits of the TSA includes:

- Ensures complete, real-time information on government cash resources

- Helps preparation of accurate and reliable cash flow forecasts

- Optimizes the cost of government operations

- Facilitates efficient payment mechanisms

- Improves operational and appropriation control during budget execution

- Enhances efficiency and timeliness of bank reconciliation

- Facilitates timely and more complete accounting statements/reports

- Co-operation of the line ministries

- Development of an Interbank settlement/clearing system

- Real Time Gross Settlement System (RTGS) at the central bank for high value transactions

- Major commercial banks and treasury connected to the RTGS

- Development of a small payments clearing system

Mr. Pattanayak described the coverage of the TSA. The minimum is to manage the entire central government. Public corporations are generally not included in the TSA. He described the possible integration of social security and other trust funds.

Mr. Pattanayak described how the TSA could include both central and sub-national governments. He also described the integration of transaction processing with government accounting systems. He warned that centralized payment systems can lead to inefficiencies and high transaction costs without IFMIS automation and accounting controls.

Many donors are concerns about putting funds into the TSA:

These donor issues can be addressed by activities such as the separation of currency sub accounts according to Mr. Pattanayak

- Assurance for use of donor aid on specific projects (or non-diversion of funds)

- Some ring-fencing to avoid liquidity problems (and ensure timely payments during project execution)

- Minimize exposure to exchange related fluctuations/losses in the value of donor aid (when currency exchange rate regime is volatile)

- Reliability of controls (in managing donors’ funds) and information produced by the national PFM systems

Mr. Pattanayak described some of the issues that need to considered when designing a TSA. He described country-specific issues. He recommended that the design of the TSA should form part of the design of an Integrated Financial Management Information System (IFMIS). He described the preconditions for establishing the TSA including political support, regulatory requirements and the need for technological integration. He emphasized the need to formalize banking agreements. The Chart of Accounts may need to be extended to cover non bank expenditure transactions. He pointed out that moving to a TSA will require some capacity development among users.

Sailendra pattanayak ts apresentation es

View more presentations from icgfmconference.

Last Day of 24th Annual ICGFM Conference

Conference Co-Chair David Nummy introduced the final day of the 24th Annual Conference with additional surveys about public financial management. An ICGFM attendee survey found the following:

- 92% of attendees say their countries have embarked on improving transparency

- 82% of attendees say that their countries have adopted international public sector standards to improve transparency

- IPSAS and GFS are the 2 most adopted international standards for #transparency

- 14% of countries represented have adopted XBRL

- Of those from countries that have not adopted XBRL 21% expect to adopt it, 2/3 interested

Labels:

budget transparency,

GFS,

ICGFM,

international standards,

ipsas,

PFM,

XBRL

Thursday, May 20, 2010

Private Public Partnership Survey at ICGFM Conference

Conference attendees were surveyed about PPPs. The results show that many PPP projects have not been successful. The lack of policy and guidelines is the most frequently sited reason for failures in PPPs.

Has your country used Public Private Partnerships to find sustainable funding for infrastructure investments:

Has your country used Public Private Partnerships to find sustainable funding for infrastructure investments:

- Yes 43%

- No 53%

- Do not know, does not apply: 3%

- Yes 39%

- No 26%

- Do not know, does not apply: 35%

- Lack of policy and guidance 45%

- Lack of PPP unit to provide guidance 20%

- Lack of government guarantees 15%

- Lack of interest from investors and operators 15%

- Political circumstances 5%

Cash Management: Managing Cash Inflows and Outflows

Mike Ablowich of the US Department of the Treasury, Office of Technical Assistance, discussed the managing of cash inflows and Outflows at the 24th Annual ICGFM Conference in Miami Florida. The presentation formed part of the workshop on government cash management.

Mike Ablowich of the US Department of the Treasury, Office of Technical Assistance, discussed the managing of cash inflows and Outflows at the 24th Annual ICGFM Conference in Miami Florida. The presentation formed part of the workshop on government cash management.Mr. Ablowich pointed out that there are accounting and banking controls than can be used. Better control over inflows and outflows enables better cash management.

Accounting controls includes allotments and appropriations. Additional accounting controls include:

- Payment frequency

- On-demand vs. once per week disbursements

- Vendor analysis

- Aggregation of multiple payments to single vendors

- Payment terms

- Mobile phone banking

- Zero balance account to eliminate idle balances

- Fraud prevention

- Wire transfers

- Automated Clearing House

- Disbursements

- Purchasing and T/E Cards

- Deposits - Paper Checks and reducing fraud through issue file, positive pay & payee name verification

- Armored car/currency

- Lock box

- Credit cards

Mr. Ablowich described the advantage of issuing purchasing cards. Purchasing cards reduce controls. Nevertheless, there are numerous advantages for purchasing cards including:

- Simplifies purchasing and payment process

- Responding quickly to disaster problems

- Provide controls by type of expenditure

- Lower overall transaction processing costs per purchase

- Increased information for analysis

- Reduced paperwork

- Set/control purchasing limits

- Simplify end of year tax reporting

Surveys at ICGFM shows some important trends in Public Financial Management (PFM) in the era of the "New Normal". Countries represented at the ICGFM conference see infrastructure investment is critical for economic expansion with education being the most important initiative. Countries are also encouraging external investment with transparency being the most important initiative to draw investment.

Does your country needs substantial investment in infrastructure to support economic expansion?

Which areas of infrastructure present the most critical need?

Does your country needs substantial investment in infrastructure to support economic expansion?

- Yes: 95%

- No: 0%

Which areas of infrastructure present the most critical need?

- Education 38%

- Transport 23%

- Renewables and Energy 13%

- Healthcare 10%

- Housing + Urban regeneration 8%

- Information Technology 5%

- Yes 70%

- No 25%

- Does not apply 5%

- Greater transparency to build investor confidence 36%

- Improve necessary infrastructure 26%

- Tax incentives 18%

- Currency reforms 8%

- Improved legal system 5%

Cash Forecasting from Cash Management Workshop

Mike Ablowich of the US Department of the Treasury, Office of Technical Assistance, discussed government cash forecasting at the 24th Annual ICGFM Conference. Cash forecasting can be used as the basis for evaluating strategic financial policy objectives. He described the entire budget planning and execution lifecycle. He emphasized the importance of cash flow forecasting during budget execution.

Mike Ablowich of the US Department of the Treasury, Office of Technical Assistance, discussed government cash forecasting at the 24th Annual ICGFM Conference. Cash forecasting can be used as the basis for evaluating strategic financial policy objectives. He described the entire budget planning and execution lifecycle. He emphasized the importance of cash flow forecasting during budget execution.Cash flow planning and forecasting synchronizes revenue estimates and spending plans according to Mr. Ablowich. The budget is built in law. But, the budget is different from the authority to spend. This results in a need for a coordinated effort to make sure that resources are available when needed to properly execute the budget and meet the needs of a variety of budget stakeholders. Mr. Ablowich pointed out that cash flow forecasting may or may not be done in conjunction with the process of preparing allotments and apportionments. He pointed out that if a strong system is in place to control spending rates then some cash flow forecasting functions presented are not entirely applicable.

Financial & Treasury Control includes comparing actual cash flows to estimates including asset and liability management to shorten "float." Mr. Ablowich said that preparing cash flow estimates will lead to improvements in the collections and disbursement processes and reduce the cost of funds. He advocates Net Present Value (NPV) analysis even though not all NPV concepts are applicable to the public sector.

Mr. Ablowich addressed liquidity management. He pointed out that liquidity management requires forecasting the cash position to manage maturities and issuance of investments and debt. In other words, "Do I have the right amount of cash when I need it?"

Cash Flow Forecasting Process

The cash flow forecasting process includes selecting forecasting horizons: short term (less than 1 month), medium term (quarterly) and long term (1 year or more). Mr. Ablowich cautions that the longer the forecast horizon, less accurate the forecast. He suggests that it does not make sense to spend time doing a daily forecast for a year from now.

Mr. Ablowich recommended coordinating many participants in cash forecasting such as spending units, central banks, macro-economic planning, treasury and budget.

It is important to remember that the Treasury, according to Mr. Ablowich, in the initial stage of the preparation of a cash flow statement, has to act as an impartial assembler of information to coordinate the preparation of a cash flow forecast. For that reason the forecast must tie back to the budget, otherwise other agencies or stakeholders will believe that the treasury is trying to alter or make judgments about the budget that has already been passed by the legislature. He pointed out that budgets are typically provided on a cash basis, so this should flow nicely into the cash forecast.

Mr. Ablowich recommends using the 80 - 20 rule. He said that this is the most important slide in his presentation to remember. 80% of revenue comes from 20% of the sources. VAT and customs taxes typically represent the 80% of government revenues. Some countries generate significant revenue from resources. Therefore, more time needs to be spent on sources that generate 80% of the revenue.

Cash Forecasting Methodologies

Mr. Ablowich described different cash forecasting methodologies. He described forecasting on afund or agency basis. The choice has to be rational and be supported by the cost/benefit of different planning, collection and forecasting techniques. If a strong I.T. system exists for compiling and synchronizing spending plans then the agency approach might make the most sense according to Mr. Ablowich. If there are three or four major fund groups of equal size then it may make sense to approach this on a fund basis.

Mr. Ablowich described forecasting on an economic or functional basis. Using the economic classification likely lends itself to the easiest forecast to compile and analyze. The functional approach is likely not needed if realistic plans are prepared by agencies on an economic classification basis.

Mr. Ablowich warned that there will always be different degrees of certainty about cash flows. Less predictable cash flow should be considered in risk management, according to Mr. Ablowich. He suggests that payroll represents a certainty for payment. But, large payments on construction projects are less certain.

The types of information sources were discussed by Mr. Ablowich. Integrated Financial Management Information Systems are a data source. The information sources need to be analyzed: cash vs. accrual accounting, treasury single account vs. multiple bank accounts, and methods of budget execution.

Cash Flow Forecasting and Budget Management

Mr. Ablowich discussed revenue forecasting. Budgets should be the source reference. A bad budget will lead to a bad cash flow forecast especially if the revenue estimates are poor from the beginning. The initial budget revenue estimate must be backed by some consistent, corroborating macroeconomic analysis.Weekly or daily estimates of the monthly plan can be prepared using historical daily data lined up against “payment due dates”. Some payments are affected by seasons.

Expenditures can be analyzed based on spending plans and historical trends according to Mr. Ablowich. The past is usually the best predictor of the future in countries with mature financial and budgetary systems. The past can be the best predictor of the future in countries with young financial and budgetary systems if information can be “normalized” for the current year’s situation. He pointed out that governments must be able to predict payroll and pensions payments. He also pointed out looking at the calendar for patterns. For example, standard payments of one source may be made every Friday. Some months have 5 Fridays.

Mr. Ablowich discussed the impact of assets and liabilities on cash forecasting. He introduced how other balance sheet accounts need to be examined for forecasting. He showed spreadsheets from Zambia and Madagascar as examples. He suggested that long-term forecasts require larger teams from throughout the government.

Cash Forecast Variances

There are numerous factors that can be responsible for variances between forecasts and actuals according to Mr. Ablowich. These include:

- Economic growth higher or lower relative to assumptions

- Economic conditions leading to increased borrowing costs or higher investment earnings

- Inflation rates higher than expected leading to higher rates of growth in indexed payments.

- Disasters/Emergency Situations

- Foreign Exchange

- Changes to tax laws by legislature that effect revenue collections.

- Payouts of settlements of court cases.

- Court interpretations of existing tax laws or spending mandates.

- Sharing ratio of taxes between levels of government.

Details about understanding and measuring "float" was presented by Mr. Ablowich. He provided clear definitions:

Collection Float

- Mail Float: the delay between the time a check (payment) is mailed and it is received.

- Processing Float: The delay between the time a payment is received and it is deposited.

- Availability Float: The delay between the time a payment is deposited and the time the account is credited.

- Mail Float: The delay between the time a check is mailed and the date the check is received.

- Processing Float: The delay between the time the payee receives the check and the time the check is deposited.

- Clearing Float: The delay between the time the check is deposited and the time it is presented to the payor’s bank for payment.

Float is measured as:

Average Daily Float = Total Dollar Days of Float/Total Calendar Days in Period

Annual Cost of Float = Average Daily Float * Opportunity Cost of Funds

Annual Cost of Float = Average Daily Float * Opportunity Cost of Funds

Cash Management Workshop Debt and Investment Policies

Laura Ross from the US Treasury, Office of Technical Assistance described debt and investment policies for proper government debt management. She described how many policy documents are obsolete. Policy documents must not be static.

Laura Ross from the US Treasury, Office of Technical Assistance described debt and investment policies for proper government debt management. She described how many policy documents are obsolete. Policy documents must not be static.Ms. Ross explained the importance of tying debt issuances to forecasts. This includes planning matching of service dates to cash forecasts. She described the type of debt vehicles like bonds and notes. She recommended that debt policies should include:

- Issuance Guidelines

- Allowable Investments for Proceeds

- Statements on Projects

- Refinancing

- Glossary of terms

- Follow the code of your state or country, then be conservative

- Be very specific in your investment policy on what can and cannot be used (examples on the next few pages)

- Investment policy needs to have oversight

- Constantly monitor information

- Monitor investment report daily

- Should be selected by a committee

- Should understand how the investment works

- Diversify the investment portfolio

- Objective – typically safety, liquidity, yield.

- Roles – who is responsible for investing the funds (ultimately)

- Investment Monitor

- Finance Board

- Ethics and Conflict of Interest

- Internal Controls

- Uses for Investment Proceeds

- Benchmarks

- Purchasing Investments – Mechanics

- Allowable Investments

- Report Components

- Glossary of terms

She recommended the following links for information on debt and investment policies:

Debt Policy Links - Links

- http://www.sykesville.net/minutes/DEBT_POLICY09.pdf

- http://www.arlingtonva.us/Departments/ManagementAndFinance/Bond/PFM%20Response%20to%20Debt.pdf

- http://www.co.hanover.va.us/finance/adopted-04/debt_policy.pdf

- http://www.loudoun.gov/controls/speerio/resources/RenderContent.aspx?data=dafd99cde3184aa2b29943686bf619d0&tabid=326

- http://www.loudoun.gov/

- http://www.arlingtonva.us/departments/Treasurer/files/file71534.pdf

- http://www.nctreasurer.com/dsthome/InvestmentMgmt/GovermentalOpsReports/asset+allocation+overview.htm

- http://www.nystar.state.ny.us/board/assets/sbtif.pdf

- http://www.treasurer.state.md.us/reports/Investment_Policy.pdf

Banking Relations

Laura Ross from the US Department of the Treasury, Office of Technical Assistance, discussed the development of Requests for Proposals for banking services. She warned that RFPs should only be issued when it is needed. There are proper times to create RFPs. You do not need an RFP to ask banks for new proposals on new services.

Laura Ross from the US Department of the Treasury, Office of Technical Assistance, discussed the development of Requests for Proposals for banking services. She warned that RFPs should only be issued when it is needed. There are proper times to create RFPs. You do not need an RFP to ask banks for new proposals on new services.Step 1 – Document the current environment

The purpose of this step is to understand the current environment for banking services, the key business and technical requirements and identify potential service gaps and improvement opportunities, according to Ms. Ross. This step includes:

- Banking Needs Assessment

- Prepare a customized packet for each area of your treasury organization regarding their current banking services

- Request current bank account analyses for all banks and accounts

- Design a checklist determining necessary information to gather from each function

Developing the RFP takes the longest time according to Ms. Ross. Ms. Ross has been on both sides of the banking RFP process. She warns that many RFPs are too large, often include the same question asked five times. The RFP provides a conceptual design of the future banking structure. This step requires:

- Develop an overall vision for banking structure and services required

- Analyze current bank account structures and providers

- Inventory and assess specific concerns and issues for bank service requirements

- Determine list of banks to be included in RFP process

- Develop the customized RFP for those selected banks and issue RFP

Ms. Ross said that the third step focuses on evaluating and prioritizing the bank responses to determine which banks can realistically be considered to move from the current to the target environment. The purpose is to objectively prioritize banks based on their capabilities and responses and to recommended banks identified to participate in bank presentations and visits. She recommends a pre-bid conference. All questions received should be officially answered in writing and provided to all bidders. The evaluation process includes:

- Customize RFP evaluation tool for bank services

- Conduct quantitative analysis of RFP responses

- Score bank RFP results on a weighted basis

- Perform additional technical and qualitative analysis on bank RFPs

- Complete cost analysis on proposed pricing using the estimated volumes

- Determine the short list of banks to participate in the presentation phase

Step 4 - Finalist Presentations and On-Site Tours

The fourth step is the research and validation to ensure that the bank can meet the current and future requirements, as stated in their response, at a level of satisfaction to your needs. This step validates the response with the real requirements. Ms. Ross provided explained the process:

- Notify the banks that did not make the final cut

- Contact the short list of banks that made the final cut to let them know of next steps and give them advance notice

- Develop the desired presentation format/script, and provide this to the banks

- Schedule the presentations and bank visits

- Evaluate the demonstrations formally and debrief after each meeting

- Conduct on-site tours of finalist banks as necessary

Step 5 - Bank Selection and Plan Development

The fifth step is the selection of the bank and development of an overall plan which will consider the key tasks, the staffing / skill requirements, timeframes and estimated costs required as next steps to move towards the targeted environment. The process includes selecting the preferred bank(s). Ms. Ross stressd that the implementation plan is the critical step. The result is a documented implementation plan for the conceptual design of the preferred banking structure. She recommends a signed contract.

Cash Management Workshop: Organization and Communication

Gail Ostler of the US Treasury, Office of Technical Assistance, recommended how cash management should be organized in governments. She described the responsibilities of the cash management unit:

Gail Ostler of the US Treasury, Office of Technical Assistance, recommended how cash management should be organized in governments. She described the responsibilities of the cash management unit:- Forecasts, monitors and tracks cash flows

- Prepares cash flow reports and identifies and reports on variances

- Provides leadership and direction to all ministries / departments on cash management issues

- Develops and maintains cash management policies and procedures

- Recommends improvements in all aspects of cash management to strengthen internal controls and enhance available cash balances

- Prepares risk and cost benefit analysis

- Maintains banking relationships

A slide showing the flow of information needed in cash management was presented by Ms. Ostler. It is important to know when there will be large pieces of revenue coming to the government. Information sources include:

- Banking System (Commercial and / or Central Bank)

- Accounting System

- Budget Spending Quotas, Plans and Amendments

- Reports Monitoring Budget Execution

- Macro-Economic Forecasts

- Major Budget Institutions (Exception Reporting)

- Revenue Institutions (Exception Reporting)

- Debt Unit

Public Financial Management RSS Feeds

ICGFM has created a pagecast in pageflakes to support RSS feeds. Many public financial management professionals may be using other RSS readers. Many may be using mobile devices. The RSS feeds in the pagecast include:

- ICGFM Blog: http://icgfm.blogspot.com/feeds/posts/default

- ICGFM Twitter: http://twitter.com/statuses/user_timeline/40955118.rss

- ICGFM Programs Twitter: http://twitter.com/statuses/user_timeline/113113941.rss

- Association for Government Accountants Blog: http://feeds.feedburner.com/agaweblog

- IMF PFM Blog: http://feeds.feedburner.com/pfmblog

- World Bank Governance Matters Blog: http://blogs.worldbank.org/governance/rss.xml

- Open Budgets Blog: http://internationalbudget.wordpress.com/feed/

- Development Gateway Zunia Blog: http://zunia.org/post

- Development Gateway Blog: http://devgateway.blogspot.com/feeds/posts/default

- Google News for Public Financial Management: http://news.google.com/news?pz=1&ned=us&hl=en&q=PFM+OR+%22public+financial+management%22+OR+%22public+expenditure+management%22&output=rss

- Grant Thornton Blog: http://feeds.feedburner.com/grantthornton/CEP/TechnologyPublications

- FreeBalance Sustainable Public Financial Management http://www.freebalance.com/blog/?feed=rss2

- Kauffman Government Post http://feeds.feedburner.com/thekaufmannpost

- Oversees Development Institute http://feeds.odi.org.uk/ODI_Governance

- Global Development Blog: http://blogs.cgdev.org/globaldevelopment/feed

What is Government Cash Management

Gail Ostler of the US Treasury says the financial crisis has created a significant awareness of the cash management. She believes that many PFM experts have a narrow view of cash management. Cash management is much more than cash flow forecasting or Treasury Single Accounts. Ms. Ostler defines cash management as "having the right money in the right place at the right time to meet government objectives."

Gail Ostler of the US Treasury says the financial crisis has created a significant awareness of the cash management. She believes that many PFM experts have a narrow view of cash management. Cash management is much more than cash flow forecasting or Treasury Single Accounts. Ms. Ostler defines cash management as "having the right money in the right place at the right time to meet government objectives."Cash Management Objectives

Ms. Oslter said that the objectives of cash management include cash mobilization, controlled disbursements, investing money and reduce borrowing. Other objectives include:

- Safeguard cash and investment

- Minimize the volume of idle balances

- Match the timing of cash inflows and cash outflows

- Reduce operational risk

- Pay vendors on time because late payments increases the cost of goods and services.

- Reduce the cost of borrowing

- Minimize transactions costs

- Increase investment income

Ms. Ostler pointed out that cash management is not a substitute for poor budgeting decision. It is not a substitute for spending in excess of budget authority or any form of budget and accounting controls. Many governments have incorrectly managed budgets through cash management according to Ms. Ostler. Many governments use Ministry bank accounts to attempt to control budgets. The result is that the government loses cash control. Ms. Ostler advocates that cash management must be delinked from budget controls.

Results of a Poorly Defined Program

Ms. Ostler articulated the problems associated with poorly defined programs, particularly those resulting from the proliferation of both private and central bank accounts. Other poor results include:

- Restrictions of the use of cash often results in unnecessary borrowing or lost investment income

- Impossible to reconcile all accounts

- Treasury isolated from cash information

- Thwart central bank monetary policy

- Cash rationing that prevents proper budget execution

- Overly expensive bank changes

Ms. Ostler defined the components of a strong program including:

- Written policies and procedures

- Strong cash management organization

- Bank relationships

- Reduction of bank accounts

- Collections made through the banking system

- Deposit accounts swept daily to central government accounts

- Treasury performs centralized payments

- As many payments as possible should be electronic

- Cash disbursements eliminated or minimized

- Ministries and agencies penalized for making commitments outside of their budget authority

- Full cash flow forecasting, on a 12 month roll-forward basis

- Follow-up on variances between cash flow forecasts and actual payments

Many cash managers analyze information in their offices according to Ms. Ostler. She advocates being proactive and understanding where there are cash is coming from. Ms. Ostler advocates that governments should look at the banking relationships in other countries.

Ms. Ostler responded to a question about deficits. She says that managing cash when there is not cash means looking at systemic issues. Governments need to reduce expenditure budgets when there are revenue shortfalls.

Procurement linkage with commitments is needed for effective cash management according to Ms. Ostler. Many long-term projects have multiple year commitments. She advocates linking with government commitment accounting systems.

Ms. Ostler said that there are ways to allow ministries to manage projects that are tied to revenues the ministry has collected without giving them cash control and separate bank accounts.

Government Cash Management Workshop

The financial crisis has increased the burden for governments to manage liquidity, cash and debt. The public financial management (PFM) workshops at the 24th. Annual International Consortium on Governmental Financial Management (ICGFM) Conference began with a full day session on cash management. The intense training was provided by financial experts from the United States Department of the Treasury.

The financial crisis has increased the burden for governments to manage liquidity, cash and debt. The public financial management (PFM) workshops at the 24th. Annual International Consortium on Governmental Financial Management (ICGFM) Conference began with a full day session on cash management. The intense training was provided by financial experts from the United States Department of the Treasury. The majority of participants at ICGFM conferences come from developing countries. The US Department of the Treasury is very active in international technical assistance to governments around the world. The workshop was led by four members of the US Treasury Technical assistance who have significant international experience:

- Laura Trimble, Associate Director, Budget and Financial Accountability, US Department of the Treasury

- Michael Ablowich, Budget and Financial Accountability, US Department of the Treasury

- Gail Ostler, Budget and Financial Accountability, US Department of the Treasury

- Laura Ross, Budget and Financial Accountability, US Department of the Treasury

Agenda for Government Cash Management training:

Session 1: Gail Ostler: What is Cash Management

- Definitions & Objectives

- What Cash Management Is Not

- Results of a Poorly Defined Program

- Components of a Strong Program

Session 2: Gail Ostler: Organization and Communication

- Establishing Cash Management Unit

- Flow of Information

- Policy Committee

Session 3: Gail Ostler & Laura Ross: Treasury Single Account & Banking Relationships

- Definition of a TSA

- Challenges and Steps to Moving toward Centralized Accounts

- Central Bank Versus Commercial Banks

- Learning About the Banking Environment

- Examples of RFPs for Banking Services

Session 4: Laura Ross: Debt and Investment Policies

- Tying Debt Issuances to Forecasts

- Short-term Versus Long-Term Debt

- Assumption of Investment Risk

- Ensuring Investments Are Secure

- Examples of US State and Local Government Investment Policies

Session 5: Mike Ablowich: Cash Flow Forecasting

- Objectives

- Process of Cash Flow Forecasting

- Components of the Forecast

- Analysis of Variances

- Understanding and Measuring Float

Session 6: Mike Ablowich: Managing Cash Inflows and Outflows

- Objectives

- Techniques

Laura Trimble: Wrap-up

- Q&A

- Evaluations

Cash management workshop english

View more presentations from icgfmconference.

Cash management workshop francais

View more presentations from icgfmconference.

Cash management workshop espanol

View more presentations from icgfmconference.

Public Financial Managments Workshops Open at 24th Annual ICGFM Conference

ICGFM Conference Co-Chair, David Nummy, opened the Public Financial Management workshop sessions of the 24th Annual Conference. He discussed the importance of cash management in government. The ICGFM conference participants were asked about the effects of the financial crisis on government. The survey results included:

ICGFM Conference Co-Chair, David Nummy, opened the Public Financial Management workshop sessions of the 24th Annual Conference. He discussed the importance of cash management in government. The ICGFM conference participants were asked about the effects of the financial crisis on government. The survey results included:- 88% of participants say that the financial crisis has affected public financial management reform in their countries

- 39% say that the financial crisis has had a positive effect on PFM reform

- 52% of participants say that the biggest effect of the financial crisis has been in revenue collection

- over 80% believe that the effects of the financial crisis on PFM reform is not permanent

Labels:

cash management,

ICGFM,

PFM,

public financial management,

US Treasury

Wednesday, May 19, 2010

Main Session of ICGFM PFM Conference Comes to an End

The main session of the 24th. ICGFM International Conference: Public Financial Management in the Era of the "New Normal" came to an end this afternoon in Miami Florida. ICGFM President, James Ebbitt closed the main session. Detailed workshop sessions begin on Thursday.

The main session of the 24th. ICGFM International Conference: Public Financial Management in the Era of the "New Normal" came to an end this afternoon in Miami Florida. ICGFM President, James Ebbitt closed the main session. Detailed workshop sessions begin on Thursday.Conference co-chair, David Nummy reflected on the changes because of the financial crisis. He observed that many countries that were considered the most stable have been more adversely affected by the crisis. Transparency and accountability demand has increased thanks to the crisis as the public questions how countries got into the crisis and how stimulus money is being spent.

Public financial managers are becoming more important. PFM managers are increasing their role in government. It is a robust and important profession according to Mr. Nummy.

Mr. Nummy suggested that XBRL adoption is reaching critical mass. XBRL promises to improve efficiencies and transparency.

Labels:

financial crisis,

ICGFM,

PFM,

public financial management,

transparency,

XBRL

XBRL Work Shop at ICGFM Conference

Liv Watson managed an XBRL workshop at the 24th Annual Conference on Public Financial Management. This is a follow-up from her presentation XBRL: The Language of Government 2.0. Attendees to the conference were very interested in the use of XBRL in government. Ms. Watson encouraged attendees to read XBRL documents on-line.

Liv Watson managed an XBRL workshop at the 24th Annual Conference on Public Financial Management. This is a follow-up from her presentation XBRL: The Language of Government 2.0. Attendees to the conference were very interested in the use of XBRL in government. Ms. Watson encouraged attendees to read XBRL documents on-line.Many countries do not mandate the use of XBRL. XBRL often becomes widely adopted according to Ms. Watson. Regulation sometimes follows adoption.

Global adoption drivers according to Ms. Watson include:

- Economics to reduce administrative burden, support multiple languages easily

- Support global standards and pressure from large international organizations

- IFRS adoption and GAAP alignment

- Support for capital market transparency

- Alignment in regulatory consistency

- Basel II banking supervision

- Integrate with multiple standards such as ISO, W3C, Swift, OECD

- Support frequent legislative changes, particularly for changes to reporting standards

- Legislature or Ministry of Finance may drive adoption

- Pressure from funding agencies for proper tracking

- Improved budget planning

- Support of decentralized reporting such as from municipalities to the central government

- Improved data collection through standards in areas such as taxation, land registration

- Integration of tax information with procurement processes

- Ease of audit through supreme audit institutions

- Encouragement from international organizations and development partners

- Improved statistical information for regulators

- Trade facilitation for regional and global trading organizations

- Ease of business registration

- Media and civil society may put pressure on governments

- Globalization affect where countries that are more transparent will be seen as more stable for business

- Demands for government transparency

- Faster closing of government accounts and production of reports

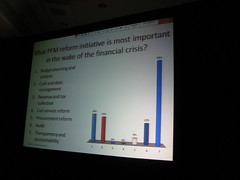

Transparency and Accountability Most Important PFM Reform

50% of attendees at the 24th Annual ICGFM Conference agreed that transparency and accountability improvement is the most important government reform necessary after the financial crisis.

50% of attendees at the 24th Annual ICGFM Conference agreed that transparency and accountability improvement is the most important government reform necessary after the financial crisis.ICGFM, the International Consortium on Governmental Financial Management, attracts members from around the world. The Public Financial Management (PFM) experts at the conference in Miami Florida come from over 35 countries.

ICGFM uses audience voting to ask questions about PFM reform. The top votes for the most important reform initiative in wake of the financial crisis was:

- Transparency and accountability 50%

- Budget planning and analysis 18%

- Cash and debt management 16%

- Audit 13%

- Procurement reform 8%

Impact of Financial Crisis on Ongoing PFM Reforms

Conference c0-chair David Nummy introduced today's theme at the 24th Annual ICGFM Conference. The conference theme is Public Financial Management in the Era of the New Normal - post financial crisis. The focus today will be on the impact of the financial crisis on ongoing PFM reforms. Mr. Nummy observed that PFM reforms have been accelerated because of the financial crisis. Government realize that improving governance, efficiency and effectiveness is necessary because of reduced government revenues.

Conference c0-chair David Nummy introduced today's theme at the 24th Annual ICGFM Conference. The conference theme is Public Financial Management in the Era of the New Normal - post financial crisis. The focus today will be on the impact of the financial crisis on ongoing PFM reforms. Mr. Nummy observed that PFM reforms have been accelerated because of the financial crisis. Government realize that improving governance, efficiency and effectiveness is necessary because of reduced government revenues.50% of attendees believe that transparency and accountability is the most important reform initiative during this era of the "new normal".

Rakesh Verma received an award for the longest trip to ICGFM at 34 hours.

The Impact of the Financial Crisis on Public Private Partnerships

Filip Drapak, Senior PPP Specialist at the World Bank discussed the impact of the financial crisis on Public Private Partnerships. He recognizes the affect of PPP on public accounts. The financial community has not provided effective guidance on how to account for PPP. Nevertheless, he remains an advocate for public private partnerships

Filip Drapak, Senior PPP Specialist at the World Bank discussed the impact of the financial crisis on Public Private Partnerships. He recognizes the affect of PPP on public accounts. The financial community has not provided effective guidance on how to account for PPP. Nevertheless, he remains an advocate for public private partnershipsThe European Union has provided some guidance on how much risk must be passed to the private sector to not show PPP investments on the government balance sheets. There is always something that doesn't go well in long-term contracts, PPPs are no different, according to Mr. Drapak.

The financial crises impact on the PPP market is not over yet, however recovery and optimism is quite strong, according to Mr. Drapak.

Unexpected stress can increase risk on PPP financing and deliverables. Mr. Drapak pointed out that financial stress can originate in unexpected places like Greece. You must expect that financial markets will undergo stress of some sort. Governance of financial markets will increase according to Mr. Drapak. He sees governance as the most important aspect to PPPs.

The financial crisis affected PPPs in liquidity, capital allocation, and the "de-risking" of projects. Debt guarantees have become a new tool in use for PPPs according to Mr. Drapak. Before the financial crisis, there was considered that large projects had less risk. But, financing issues have resulted in many smaller projects. And, some of the risks that were exclusively with the private sector before the crisis is now shared with the public sector. Mr. Drapak asks how governments can show market disruption risks on financing on the books?

The financial crisis has put pressure on PPP governance. Mr. Drapak provided PPP case studies from the UK, South Africa and Russia. The UK is the largest PPP market, according to Mr. Drapak. India has emerged as the second largest world market. The UK created a special agency called "Partnership UK". There is a plan is to make an organization, within Treasury, called "Infrastructure UK." The Treasury of the Government of South Africa is creating a separate PPP organization in order to separate delivery from regulatory interests. The Government of Russia viewed that PPPs were unnecessary because of large budget surpluses. Now, the Government is developing PPPs. Russia is managing PPPs through its own development bank.

Mr. Drapak says that governments did consider the full lifecycle of PPP projects. However, there had not been any planning associated with potential financial crisis. PPP projects today suffers from the increased cost of equity. This requires higher levels of financing by governments which tends to reduce the value for money. In some projects, the government had to replace all private financing while the private sector has the equity risk.

Mr. Drapak discussed global PPP trends showing an increase in activity in BRIC countries. He showed a case study from Canada for Partnerships BC. The organization looked at the internal rate of return while looking at the public contribution to debt. Some people wonder whether government funding is a PPP. Mr. Drapak points out that banks have very little risk in PPPs, so government funding does not change the fundamentals of PPPs. This option is really only available to governments with stable revenue.

Mr. Drapak believes that the financial crisis is improving PPP governance. He also pointed out that the analysis of PPP projects tend to look at full lifecycles unlike traditional capital financing. This often results in better long-term planning for PPPs.

Developed countries tend to leverage PPPs to improve efficiency, according to Mr. Drapak. Developing countries tend to use PPPs for other reasons. The finance crisis means that developing country governments tend to have to take more financing risk than developed country governments.

Filip Drapak has over 14 years of experience in economics, public policy, and finance. Mr. Drapak has worked as assisting professor at Prague University of Economics, as a head of financial advisory services in Societe Generale Komercni banka and as assistant director in corporate finance of PricewaterhouseCoopers During the past six years, Filip was involved in the area of public-private partnerships (PPP) and was instrumental in the creation of PPP Centrum, under the Ministry of Finance to provide technical assistance and support to public entities engaged in public private partnerships. He introduced the Czech Republic's policy for public-private partnerships and was involved in training for the public sector as well as in the formulation of legislation for privatization and concessions.

Mr. Drapak served as the CEO and Chairman of the Board of Directors of the PPP Centrum, as a non executive Chairman of electric distribution company, oil transport company and on boards of airlines company and energy engineering company.

Labels:

Filip Drapak,

PPP,

public private partnerships,

World Bank

Tuesday, May 18, 2010

Second Day of 24th Annual ICGFM Conference Comes to an End

David Nummy, conference co-chair, summarized the second day of the Annual Conference in Miami. Mr. Nummy reflected on how countries reacted well to the financial crisis and the "new normal".

Innovation in the public sector was the primary theme of the afternoon sessions. But, the theme of the day, according to Mr. Nummy, is the acceleration of transparency in government based on the financial crisis.

Financial Crisis accelerates PFM Reform

David Nummy introduced the second day of the 24th Annual ICGFM Conference by reflecting on the recent article from the IMF PFM blog. This recent article agrees with the conclusion from last year's conference in Miami - the financial crisis is accelerating PFM Reform.

David Nummy introduced the second day of the 24th Annual ICGFM Conference by reflecting on the recent article from the IMF PFM blog. This recent article agrees with the conclusion from last year's conference in Miami - the financial crisis is accelerating PFM Reform.Last year's conference found wide agreement that public financial reform is key to overcoming the financial crisis.

Labels:

financial crisis,

ICGFM,

IMF,

public financial management

XBRL—A Language of the Government 2.0 World

Liv Apneseth Watson, Senior Executive, IRIS Business Services described XBRL. She explained how XBRL is changing financial reporting in the public sector. XBRL is not about technology, according to Ms. Watson, it is about solving major data problems. XBRL is, fundamentally, an electronic language that helps both the private and public sector effectively and efficiently bridge the current gap between business systems by crossing artificial boundaries. She challenged the audience to consider the amount of re-keying of financial data done today and the difficulty in finding business information on the Internet.

Ms. Watson said that XBRL is like universal bar codes but for financial reporting. Compelling reasons for XBRL:

- Making financial and business information exchange better, faster, and cheaper

- Making financial reporting more transparent and discoverable

- Explicitly articulating business meaning and thus enabling the exchange of that meaning between humans or between business systems

- Improving data integrity

- Integrating business systems

- Saving government agencies money and making them more efficient

XBRL is tagged data that is machine readable. It is a standard way to communicate business and financial information. XBRL is an open source international standard operated by a non-profit consortium. It is more than financial reporting. It provides a global business reporting supply chain. Machine readable makes data re-usable.

Ms. Watson described how XBRL provides more functionality than previous methods. XBRL uses" hyperlinks on steroids," according to Ms. Watson. She described the taxonomy of an XBRL item. The presentation element of XBRL enables translating labels to multiple languages. This reduces the cost to report in multiple languages.

The methods for calculating business and statistical information can be linked to the XBRL item. This means that the information will be presented based on national or international standards. XBRL can also help identify mathematical errors in financial reports. She also described XBRL in context to spreadsheet applications. XBRL has the intelligence to label, identify context and show formulas eliminating "Excel hell". Anyone with data locked with proprietary systems will be at a disadvantage compared to those with open discoverable data, according to Ms. Watson.

Many governments have adopted XBRL. Her presentation described:

- Macedonia reporting portal

- International Accounting Standards Board

- Securities and Exchange Commission - USA

- Federal Deposit Insurance Organization - USA

- Committee for European Securities Regulators

- State of Nevada

XBRL will enable the semantic web and linked data, according to Ms. Watson.

Liv A. Watson heads Global Business Development for IRIS Business Services Private Limited. She is one of the founders of the XBRL Intentional Consortium. She is the co‐author and contributor author to several of books including “XBRL for Dummies” and Governance, Risk, and Compliance Handbook published by Wiley.

Liv watson icgfm xbrl a language of the government world english

View more presentations from icgfmconference.

Liv watson icgfm xbrl a language of the government world espanol

View more presentations from icgfmconference.

Liv watson icgfm xbrl a language of the government world francais

Ms. Watson suggested the following links for more information:View more presentations from icgfmconference.

Labels:

GASB,

Gov 2.0,

Government 2.0,

ICGFM,

IRIS Business Services,

linked data,

SEC,

semantic web,

taxonomy,

transparency,

XBRL,

XML

Innovative Uses of Technology in the Public Sector

Stephen G. Fridakis , chief of IT programs and quality assurance of UNICEF. Mr. Fridakis of asks where the public sector can innovate. Can only the private sector innovate? He believes that innovation is caused by people who are angry. There is a lot of innovation in the public sector, according to Mr. Fridakis.

Mr. Fridakis discussed innovation and strategic planning in organizations. He pointed out that innovation means redesigning the organization. Operational improvements and "me too" approaches is not strategy. Planning is often incremental. Organizations rarely create, we imitate. We spend more time on analytical tools that are not effective.

Although the public sector does not have the same bottom line measurement of the private sector, there are ways to evaluate goals, according to Mr. Fridakis. The public sector can be aware of customer goals. He advocates the notion of moving from the project approach to a portfolio approach in the public sector.

Mr. Fridakis looked at the notion of public value. Public sector innovation is about new ideas that work at creating public value. Public value is an analogy to value-added in the private sector. It is not good enough to be happy internally to the organization. There needs to be more effective measurements of public value.

Capacity building in IT is critical to innovation in countries, according to Mr. Fridakis. Capacity building means reducing the reliance on foreign consultants. Organizations need to make IT innovation sustainable. And, the customer context needs to be understood.

Mr. Fridakis applied a private sector strategic framework to the public sector. This framework includes business goals, identifying the customer, products & services, and establish new controls. He has found that government reform must be in sync with innovation.

IT in UNICEF is a difficult organization to innovate because of the hierarchical organization, strong controls and decentralization, according to Mr. Fridakis. The organization operates with both a cash and an accrual basis.

Why is innovation good? Mr. Fridakis identified a number of ways:

- Improved efficiency

- Improved ease of use

- Integrates easier with the private sector

- Enables collaboration and knowledge transfer

Mr. Fridakis described the benefit of accessing policy documents over time. UNICEF is looking to store this information with taxonomies to make them easier to find.

Mr. Fridakis believes that if we have access to information, we can predict potential natural and economic disasters. He stated that "innovation is the ability to see change as an opportunity - not a threat."

Mission-driven public sector organizations can leverage technology innovation, according to Mr. Fridakis. Transparency and outreach are enabled through innovation.

Stephen Fridakis has responsibility for the oversight, coordination of IT Programs worldwide. Prior to that he was the Chief Information Security Officer of the United Nations Development Programme, the UN's global development network. He is the former Chief Security Engineer of BearingPoint, where he had enterprise-wide responsibility for IT security of government and defense contracts.

Stephen fridakis innovative uses of technology in the public sector english

View more presentations from icgfmconference.

Stephen fridakis innovative uses of technology in the public sector francais

View more presentations from icgfmconference.

Labels:

ICGFM,

ICT4D,

innovation,

PFM,

public financial management,

public value,

strategic planning,

UNICEF

Using XBRL to Improve Transparency in Brazilian Government

Ana Cristina Bittar de Oliveira, IT Department, National Treasury Secretariat, Ministry of Finance, Brazil described how new technologies are bringing greater access to public information. She described how information technology can be used to bring transparency and reform to governments. She described the Financial Data Collection System (SICOF) Project in Brazil.

States and Municipalities in Brazil had different standards making it difficult to compare across governments. Transparency and standard reports were difficult to prepare. She described the Fiscal Responsibility Law for transparency in government entities. Government entities need to be transparent to receive transfer payments. Brazil has developed accounting standards through a common chart of accounts. These standards are being rolled out to all levels of government.

The data collection system in use, called SISTN, was developed quickly. The system is difficult to maintain because it uses an Excel-type manual data entry. The reporting process is complex. The output in PDF format is not user friendly, according to Ms. de Oliveira. It does not support re-use of data. The system is high maintenance.

•

The government of Brazil decided to create a more effective standard and automate the system. The motivation was to reduce administrative costs, make data more flexible and ensure that all data is consistent across the government, according to Ms. Oliviera.

Ms. Oliveira described the integration approach using XBRL. The eXtensible Business Reporting Language (XBRL) is a language for the electronic communication of business and financial data which is revolutionising business reporting around the world. It provides major benefits in the preparation, analysis and communication of business information. It offers cost savings, greater efficiency and improved accuracy and reliability to all those involved in supplying or using financial data.

Ms. Oliveira described how XBRL supportse the Common Chart of Accounts in a very convenient format. The Chart of Account is the basis for the definition of the Reports data dictionary or taxonomy. And, the taxonomy can be extended to support other government needs. She said that part reporting burden is managed the taxonomy. This reduces the cost and burden of the reporting process in local and regional governments. She said that the Government of Brazil has not encountered a better approach than XBRL.

Governments in Australia, New Zealand, Singapore and the Netherlands are leveraging XBRL. The Government of Mexico is also considering XBRL. Ms. Oliveira emphasized that the use of open standards enables more cooperation on good practices across governments.

Ana cristina bittar de oliveira icgfm xbrl in brazil government espanol

View more presentations from icgfmconference.

Ana cristina bittar de oliveira icgfm xbrl in brazil government english

View more presentations from icgfmconference.

Subscribe to:

Posts (Atom)